Define Chart of Accounts using Accounting flexfield

Navigate to GL Responsibility > Setup > Financials

> Flexfields > Key > Segments

Before navigating further, let’s have a quick overview of

Flexfields. A Flexfield is a collection of Structures. A structure is a

collection of segments. A Segment contains value sets & a value set is a

collection of values

Query for Accounting Flexfield

& add another row

Give details as shown below & save the record

Click on Segments Tab & give details as shown below

Note that we have used a seeded value set for the account

segment. We can also create our own value set. For other segments, we’ll use

custom value sets only

Define Value set for Company

Click on first row & click on Value Set. Give details as

shown below

Similarly define Value sets for Division & Department

Now assign these value sets to the corresponding segments

& save the record

Define Company as

balancing segment. A balancing segment is a unique & mandatory segment.

To which ever segment we associate the Balancing segment qualifier, application

will always balance the journals for that segment.

Define Account as

Account Segment. By doing so we are going to enable account type segment

qualifier which is used to determine the nature of account.

Select first row & click on Flexfield Qualifiers. Give

details as shown below

Save the record & similarly do for Account segment

With this the flexfield structure is ready (except adding

values to value sets). Enable Freeze Flexfield Definitions & Allow Dynamic

Inserts & click on Compile

Now assign values to value sets. Navigate to Setup >

Flexfield > Validation > Values. Search for the value set Name & give

details as shown below

Define Accounting

Setups: These are the common setups required to process financial

transactions across all financial application.

Navigate to Setup > Financials > Accounting Setup

Manager > Accounting Setups à Click on Create Accounting Setup

Click on Create Legal Entities

Legal Entity: Legal Entity is the legal business or a

registered firm. At this level, we prepare our income tax reports.

Give Identification Information as shown below

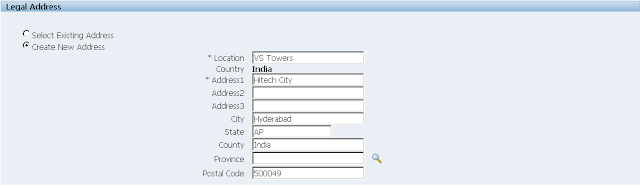

Click on Create New Address & give details as shown

below

General information is an optional part. Click on Apply

Similarly create another Legal Entity & give details as

shown below

Click on Next & give details as shown below

Here the Subledger Accounting Method Name is Standard

Accrual.

Click on Next & then Click on Finish

Once done, you’ll get a message

This comment has been removed by the author.

ReplyDelete